Despite facing some turbulence in the middle of the week, the price of Bitcoin (BTC) ended the week on a positive note, with an overall price gain of 4.07% according to data from CoinMarketCap. This positive performance allowed BTC to continue its upward trajectory from the previous week when it surpassed the $60,000 price mark. However, despite these gains, it remains uncertain whether the leading cryptocurrency has entered a bullish trend.

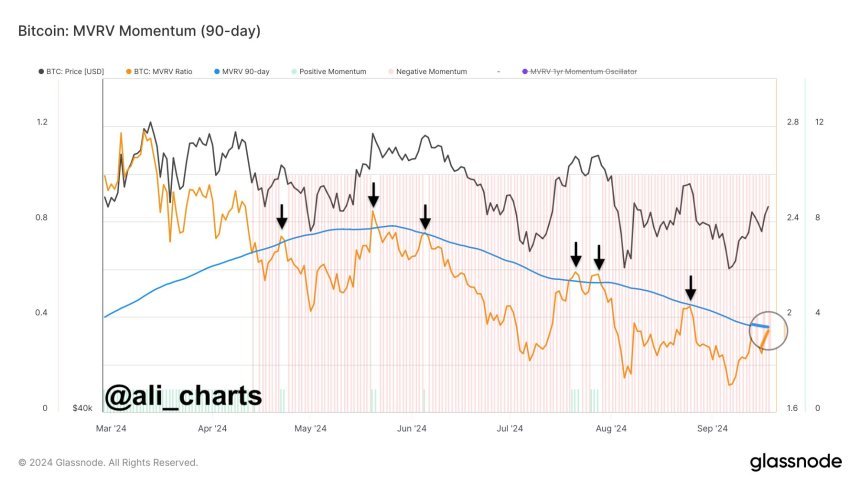

On Friday, popular crypto analyst Ali Martinez shared a market condition that could signal BTC’s return to a bullish phase. Over the last two weeks, Bitcoin has seen a gain of over 23%, moving from around $52,800 to a peak price of $64,041. Martinez believes that the Bitcoin Market Value to Realized Value (MVRV) ratio needs to close above its 90-day moving average to confirm a bullish trend after weeks of sideways movement in July and August.

The MVRV ratio is a metric used to assess the Bitcoin market trend, with a high ratio indicating potential overvaluation of the asset and a low ratio signaling undervaluation. When Bitcoin’s MVRV crosses below its 90-day moving average, it suggests the asset is in a correction or bearish phase, with investors likely holding unrealized losses that could lead to negative sentiment. On the other hand, when the MVRV moves above its 90-day moving average, it indicates bullish momentum as Bitcoin’s market value surpasses historical averages.

Martinez believes that for Bitcoin to transition into a bullish phase, the MVRV ratio must move above its 90-day moving average, potentially pushing the price of BTC to $68,000-$70,000, where a significant resistance level lies. If this scenario plays out, Bitcoin could see positive performance in September, a month traditionally known for bearish returns.

In other news, Bitcoin traders have opened approximately $2 billion in futures contracts over the last 48 hours following the recent price surge of the asset. While this surge in futures contracts signals high market interest in Bitcoin, it also represents a rise in leveraged positions. Martinez warns that this situation poses a long-squeeze risk, where if the price of BTC drops, these traders’ positions may be forcefully liquidated, leading to downward pressure on Bitcoin’s price.

As of the time of writing, Bitcoin is trading at $62,875 with a 1.59% loss in the past day. The asset’s daily trading volume has decreased by 16.75% and is currently valued at $36.4 billion.

In conclusion, despite recent price gains and positive momentum, the future trajectory of Bitcoin remains uncertain. Analysts like Ali Martinez are closely monitoring key indicators such as the MVRV ratio to gauge whether Bitcoin is on the cusp of a bullish trend. Traders and investors should exercise caution and stay informed about market developments to make informed decisions in the volatile cryptocurrency market.