Anthony Scaramucci, the Founder and Managing Partner at Skybridge Capital, a global investment firm, recently made headlines by asserting that Bitcoin (BTC) is not a reliable store of value. Despite his previous support for BTC and his reputation for candid financial analysis, Scaramucci provided a reason for his belief, highlighting the challenges that Bitcoin faces in the current regulatory landscape.

In an exclusive interview on CNBC’s Squawk Box, Scaramucci explained why he believes that BTC falls short as a store of value in the financial sector. His critique centered around the negative impact of the crypto industry’s regulatory framework, which he believes undermines Bitcoin’s credibility as a store of value. When asked about the comparison between BTC and gold, Scaramucci emphasized that gold has outperformed Bitcoin in recent years, with gold rising over 30% while BTC has remained stagnant. This, according to Scaramucci, makes gold a more reliable store of value.

Scaramucci also pointed out that for Bitcoin to be considered a reliable store of value, its adoption would need to expand significantly, with over a billion active crypto wallets. While he acknowledged that Bitcoin could potentially become a store of value in the future, he argued that it does not hold that status currently due to regulatory challenges and the lack of proper frameworks in the industry.

Despite his reservations about Bitcoin as a store of value, Scaramucci highlighted the technological advancements of BTC, particularly in integrating payments and rail systems. He suggested that Bitcoin’s technology could potentially benefit the US economy by reducing transaction costs and improving efficiency and innovation.

During the interview, Scaramucci made a bold prediction that Bitcoin could climb to $100,000, setting a new all-time high. However, he noted that the cryptocurrency’s price surge was taking longer than expected due to regulatory hurdles, market uncertainty, and previous fraud incidents. When asked about the recent price actions of Bitcoin, Scaramucci attributed the price surge to investments in Spot Bitcoin ETFs and institutional investors buying BTC. He noted that the launch of Spot Bitcoin ETFs earlier this year triggered BTC’s rise to an all-time high above $73,000.

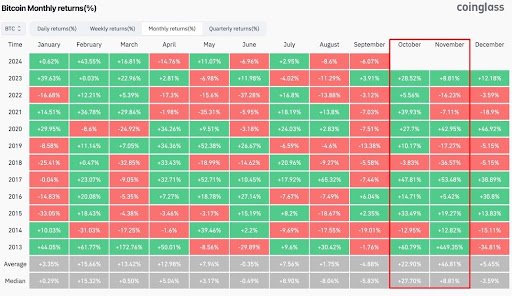

Before this price increase, Bitcoin had been trading around $30,000 in 2023 and even dipped to about $17,000 at one point in 2022. Scaramucci praised Spot Bitcoin ETFs for achieving the most successful ETF launch in history, emphasizing their impact on the price of the cryptocurrency.

In conclusion, Scaramucci’s views on Bitcoin as a store of value reflect his concerns about the regulatory challenges facing the cryptocurrency industry. While he acknowledges Bitcoin’s potential as a future store of value, he believes that it currently falls short due to these obstacles. Despite this, he remains optimistic about Bitcoin’s technological advancements and its potential to benefit the US economy.